Banking and Financial Solutions

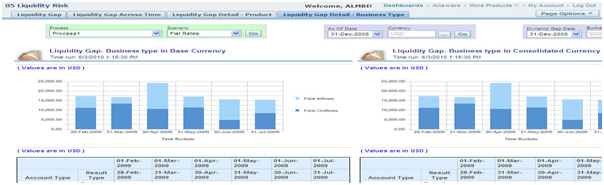

In today's financial markets, banks & financial institutions in their operations face different types of risk challenges that will affect the institutions in running their business normally. Since the global crisis, banks are prone to risk. The kind of risk banks are facing are credit risk, market risk, operational risk, liquidity risk, dilution risk, country risk & business risk to name a few. Risk and Returns are core pillars of Financial System and Banking Industry.

Quinco Consulting enables banking and financial services institutions with Risk, Fraud, Compliance and Reporting embedded analytics using Integrated application. Thereby providing a single solution that helps financial institutions grow, manage risk, and meet risk-adjusted performance objectives with minimal effort in terms of cost and time.

Quinco Consulting helps in implementing below Analytical Solutions:

- Oracle Financial Services Advanced Analytical Applications (OFSAAA)

- Moody’s Analytics

- Lombard Risk Solutions

- SAS Solutions

- Small Business Automations

IFRS Forecasting

During the financial crisis, the delayed recognition of credit losses on loans (and other financial instruments) was identified as a weakness in existing accounting standards. Most major capital markets are now actively discussing or pursuing efforts of convergence towards single sets of globally accepted accounting and auditing standards. One direct financial consequence of the regulation for banks is lower operating margin and profitability, stemming from higher provisioning required, as well as impact on a bank’s capital, liquidity and leverage. Banks face pressure on net interest margins on a risk adjusted basis.

The practical challenges faced by Financial Institution in adopting IFRS:

- Significant increase in credit risk

- Observation period for modified accounts

- Estimation of expected cash flows for undrawn portion

- Effective maturity for Revolving Lines of Credit (deliberation in progress)

IFRS solution provides a framework for making the calculations needed to ensure compliance with the standard. The solution is designed to take data from a staging area that is common across all Analytical Applications installations and enable its reuse for analytical needs. The solution also provides for prebuilt rules and workflows for stage assessment. These rules are based on commonly based assessment criteria such as rating migration, days-past-due migration, industry classification and migration. Additionally, the solution allows users to configure additional rules based on their own models for stage assessment. A complete set of financial statements includes a statement of financial position, a statement of comprehensive income, a statement of cash flows, a statement of changes in equity, a summary of accounting policies, and explanatory notes.

Scenario Analysis

- Comprehensive stress testing capability that enables loss forecasts under stress conditions

- Flexible shock definition & scenario management which allows assessment under multiple shocks values to be specified on the same set risk variables

- Enterprise-wide stress testing capability which allows institutions to design stress scenarios catering to a wide variety of risk events and covering multiple risk areas

As a consulting organization, Quinco Consulting consultants have strong domain expertise providing full life cycle implementation. We have experienced consultants in consulting Analytical Application and Integration services. Quinco Consulting consultants come from the Industry experience and are highly experienced in integrating the Reporting standard using IFRS. Quinco Consulting can help Financial Institutions in reducing data redundancy, credit risk and meet their challenges.